Let’s talk about price action trading. It’s a way to trade by analysing how an asset price moves. Instead of just using indicators or oscillators, price action trading uses the actual raw data of prices to decide when to trade. This method allows traders to see trends, areas of Supply and demand, and general market feelings. Knowing how to read price action gives traders a deeper understanding of the market. This can help them make smarter trading choices.

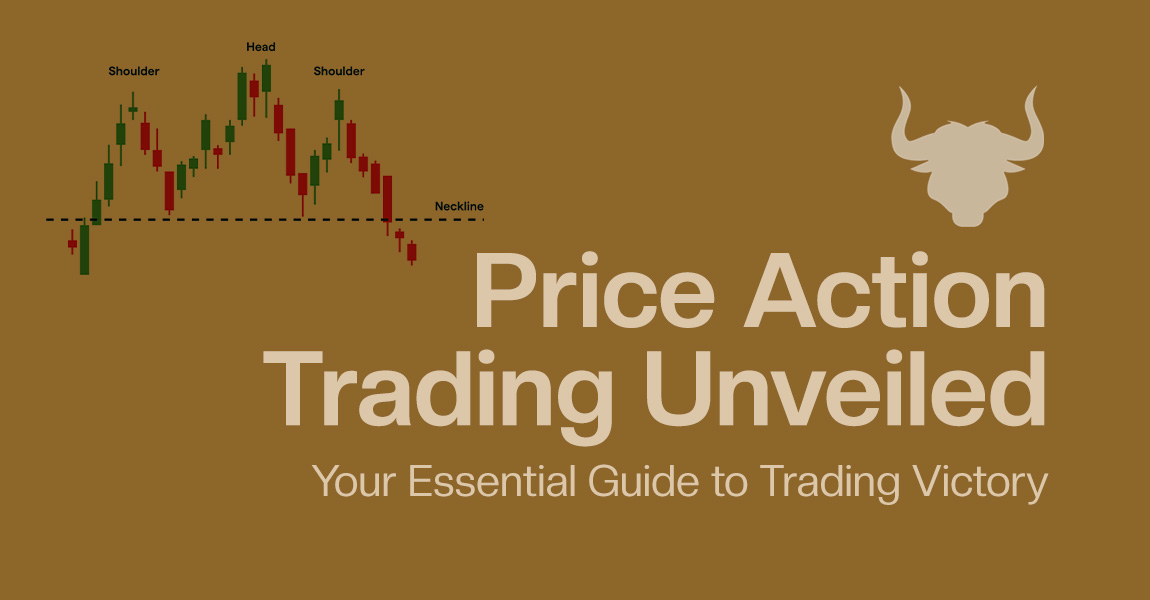

Price action trading has many strategies that you can use to take advantage of how the market moves. Breakout trading is when you start trading when the price goes over or under a vital support or resistance level. Pullback trading is different. It’s when you begin trading during brief setbacks in a current trend. And then there’s reversal trading. This strategy is about spotting possible trend changes based on candlestick patterns or chart patterns.

Let’s examine a few real-life examples to illustrate the effectiveness of price action trading. In a breakout trade, a trader might enter a long position when the price breaks above a critical resistance level, anticipating further upside momentum. In a pullback trade, a trader might wait for the price to retrace to a confluence of support levels before entering a long position, riding the trend higher. However, exercising caution and managing risk effectively is essential to avoid common pitfalls such as overtrading or chasing the market.

In Jalandhar, our price action trading course provides a robust program. It helps traders know how they need to win in the markets. It goes from grasping price action analysis basics to applying complex trading strategies. But rely on something other than our words. Listen to what our former students share about their experiences with us.

Ready to elevate your trading game? Enroll in our Price Action Trading Course in Jalandhar today and gain the skills you need to succeed in the dynamic world of finance. Don’t miss out on this opportunity to unlock your trading potential and achieve your financial goals. Join us now and start your journey to trading mastery!